Days Payable Outstanding (DPO) is a key financial metric that indicates how long a company takes to pay its suppliers.

A well-managed DPO can lead to improved cash flow, allowing a company to use its available funds more effectively. It also impacts relationships with suppliers, as consistently delayed payments can strain these relationships, potentially leading to less favourable credit terms or supply chain disruptions.

Let’s go into more details in order to get a better understanding of this metric and what it means to the financial landscape of the business.

What is DPO?

Days Payable Outstanding (DPO) measures the average number of days a company takes to pay its bills and invoices to suppliers. It’s a critical indicator of a company’s payment practices and financial health. A high DPO means the company is taking longer to pay its suppliers, which can free up cash for other uses. A low DPO indicates faster payments, which might mean better supplier relationships but less cash on hand.

DPO Formula

The formula for calculating DPO is:

A breakdown of the components:

Accounts Payable: The total amount the company owes to its suppliers.

Cost of Goods Sold (COGS): The direct costs linked to the production of the goods the company is selling.

Number of Days: The period over which you want to calculate the DPO, typically 365 days for a year.

Steps to calculate DPO

Determine accounts payable

Look at the company’s balance sheet to find the total accounts payable. This figure represents the money owed to suppliers for purchases of goods and services, made on credit. Since accounts payable is money owing to creditors and appears on the balance sheet under current liabilities, it qualifies as a liability.

A company’s short-term liabilities are known as current liabilities, and they usually last less than a year. With periods of only a month or two, accounts payable often lie on the shorter end of the current liability range.

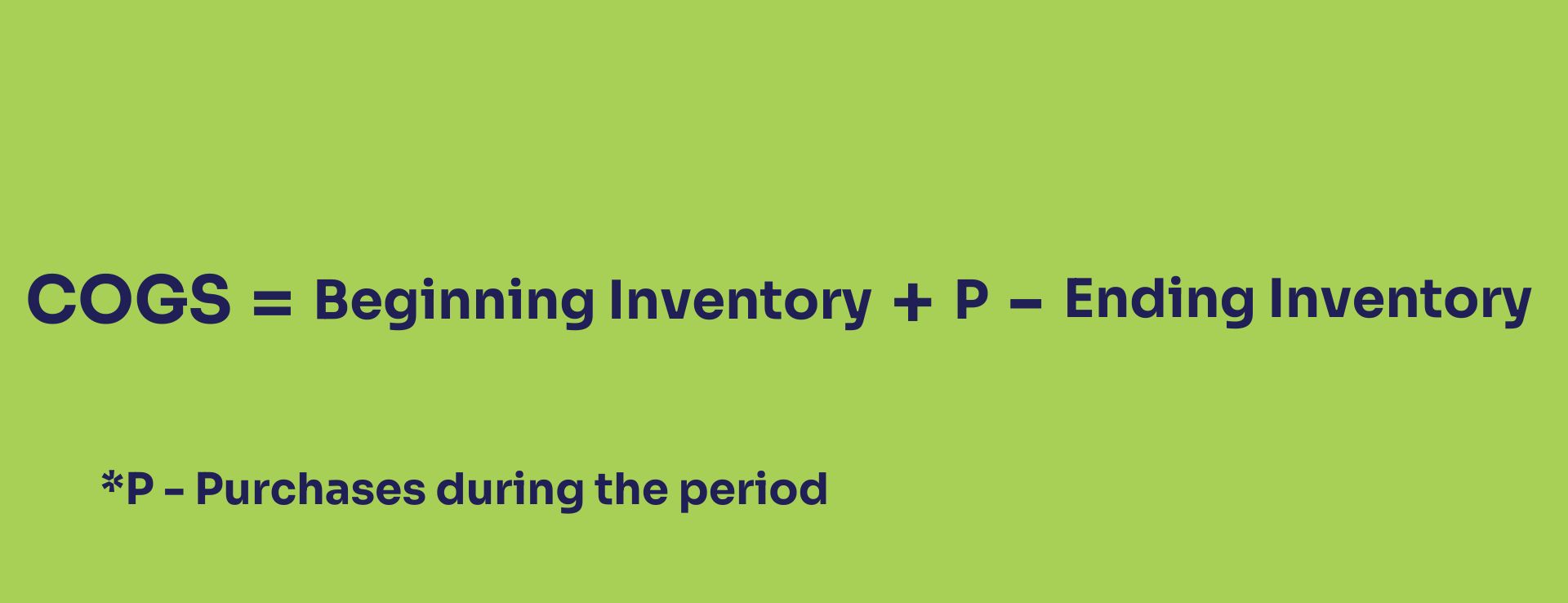

Identify Cost of Goods Sold (COGS)

Find the COGS on the company’s income statement. This value includes all direct costs of producing goods sold by the company during the period. Direct costs typically include raw materials, labour, and manufacturing expenses directly tied to the production process. By accurately determining COGS, businesses can better understand their production costs, set appropriate pricing, and calculate gross profit. It’s important to regularly review and update COGS to reflect any changes in production costs or processes, ensuring accurate financial reporting and analysis.

Do you find this article interesting?

Subscribe to our Newsletter for updates on the latest blog articles.

The formula:

Select the time period

Decide the time period for the calculation. For annual DPO, use 365 days. For a quarter DPO, you can use 90 days.

Apply the DPO formula

Once you have all the necessary components plug the values into the formula.

Practical example

Let’s say Company XYZ has $400,000 in accounts payable and its annual COGS is $1,600,000. Using the formula:

DPO = (400,000 / 1,600,000) × 365 = 91.25 days

This means Company XYZ takes an average of 91.25 days to pay its suppliers.

Interpreting DPO

High DPO: Indicates that the company takes longer to pay its suppliers, which can help with cash flow but may strain supplier relationships. This extended payment period can free up cash for other operational needs or investments, potentially improving the company’s liquidity. However, it’s crucial to balance this benefit against the risk of damaging relationships with suppliers. Consistently late payments might lead suppliers to demand stricter payment terms, reduce credit limits, or even charge late fees. In the long run, strained supplier relationships can affect the reliability of supply chains and the ability to negotiate favourable terms in the future.

Low DPO: Suggests the company pays its suppliers quickly, which can foster good relationships but might limit cash availability for other needs. Prompt payments can lead to stronger supplier relationships, potentially resulting in better credit terms, discounts, and preferential treatment. Suppliers may prioritise a company with a low DPO for quicker order fulfillment and more favourable negotiation terms. However, the downside is that paying suppliers too quickly can strain the company’s cash reserves. This might limit the funds available for critical business operations, investments, or emergency expenses, potentially impacting overall financial flexibility and growth opportunities.

DPO against industry benchmarks

To find out how your company’s payment policies compare to those of your competitors, it is important to compare your DPO to industry benchmarks. Industry benchmarks serve as a point of comparison, giving you information about typical terms of payment and financial practices in your industry. A DPO that is much higher than the industry average may be a sign of better terms for credit with suppliers or of effective cash management, which permits reinvestment in the company’s activities. If, however, payments are often delayed above acceptable limits, that can also be an indication of possible cash flow problems or damaged supplier relations.

On the other hand, if your company’s DPO is below the industry average, it can indicate your business cherishes good supplier relationships and a strong financial position because it can pay its debts faster. This can improve the reputation of your business and result in better terms, discounts, or priority treatment from suppliers. It may also, however, suggest an overly cautious attitude towards cash management, whereby funds that may be allocated to investments or expansion are locked up in early payouts. What you need to always have in mind is that you need to routinely compare your DPO to industry norms, so that you can keep your strategy balanced and make sure that your business manages its cash flow and supplier relationships efficiently, keeping it competitive.

Conclusion

Maintaining good supplier connections and managing a company’s cash flow depends on DPO monitoring. Calculating and evaluating DPO, can give you important insights into your company’s financial processes and pave the way for making well-informed business decisions. Regular DPO assessments help identify trends and patterns that could indicate shifts in financial health or supplier relationships.

A consistent approach to monitoring DPO allows for timely adjustments, ensuring that the company can respond proactively to all the changes in market conditions or internal financial dynamics.