The Financial Challenges Facing Spanish Construction Suppliers

Spain’s construction industry is dealing with serious financial pressure. Between rising logistics costs, labor shortages, and delayed payments, suppliers are being squeezed on all sides. Many of them are looking for ways to stabilize cash flow and keep their businesses running smoothly without relying on expensive loans or factoring.

Here’s what’s making things more difficult:

1. E-commerce Growth Is Driving Up Logistics Costs

Spain’s e-commerce sector has grown significantly, with a record 1.303 billion shipments handled in 2024, marking an 8.6% increase compared to the previous year. This growth has intensified demand for logistics services, including transportation, warehousing, and last-mile delivery, contributing to rising costs for businesses.

In addition, the logistics market in Spain is evolving as e-retailers increasingly outsource services such as inventory management and warehousing to ensure faster and error-free deliveries.

The logistics sector represents 8% of Spain’s GDP and faces challenges such as cost overruns due to political and regulatory uncertainty, further impacting operational expenses.

2. A Shrinking Workforce Is Slowing Projects

Another troublesome fact is that the construction sector in Spain faces a significant labor shortage, with an estimated need for 700,000 more workers to meet demand. Despite steady employment growth in recent years, the sector employs almost the same number of workers as it did during the post-real estate bubble decline in 2010.

Over 50% of construction companies report difficulties finding skilled personnel, leading to delays in projects and increased costs due to higher wages and material price fluctuations.

ManpowerGroup projects a persistent deficit of up to 450,000 jobs by 2026, exacerbating delays and cash flow issues for suppliers reliant on timely payments.

3. New EU Late Payment Rules Don’t Solve Everything

When it comes to regulations and laws, the new EU’s Late Payment directive was supposed to bring a bit of harmonization in this regard but it seems as it did not solve every critical aspect. The Directive aims to reduce payment delays by enforcing a maximum payment term of 30 days for commercial transactions. However, enforcement challenges persist due to power imbalances between large buyers and smaller suppliers.

In Spain, the average payment period remains above 80 days, far exceeding EU standards and causing significant disruptions in cash flow for SMEs and construction companies.

Despite regulatory updates, loopholes such as extended verification processes and voluntary waivers of remedy measures allow dominant players to delay payments without legal consequences, undermining the intended protections for suppliers.

A Smarter Way to Manage Cash Flow

Given these challenges, construction suppliers need a better way to manage working capital without taking on debt. Supply chain finance (SCF) offers a solution by allowing suppliers to get paid earlier – without affecting the buyer’s payment schedule. In the next section, we’ll break down how SCF works and how suppliers can use it to improve financial stability.

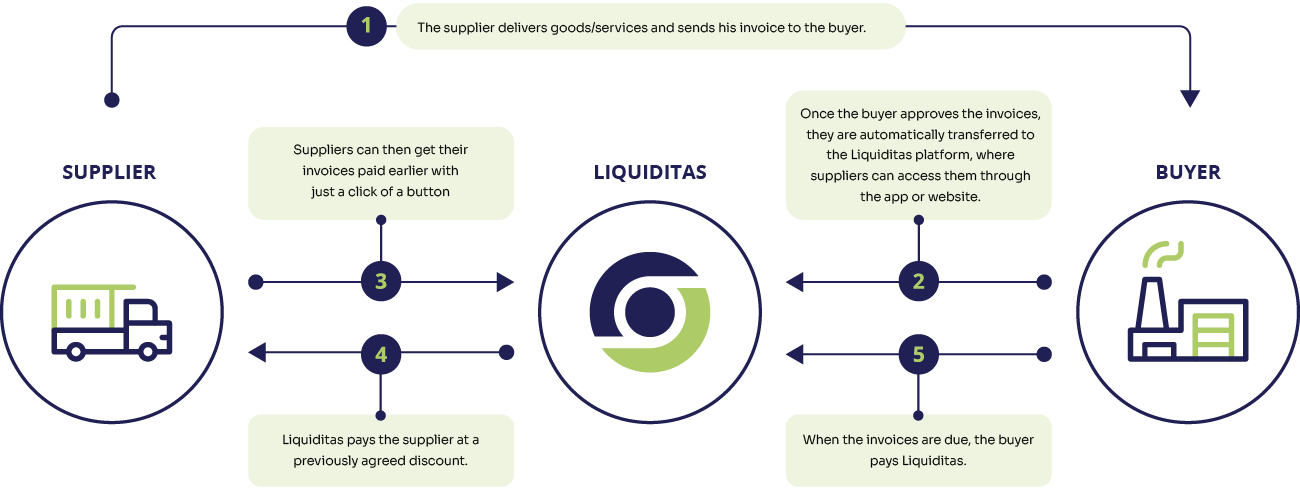

The SCF Mechanics: How Liquiditas Works

This section explains the step-by-step process of how Liquiditas’ Supply Chain Finance (SCF) solution operates, providing suppliers with faster access to cash flow while ensuring seamless coordination with buyers.

Do you find this article interesting?

Subscribe to our Newsletter for updates on the latest blog articles.

- Supplier Delivers Goods/Services

The supplier fulfills their obligations by delivering goods or services to the buyer and subsequently sends an invoice for the transaction. - Buyer Approves the Invoice

Once the buyer validates and approves the supplier’s invoice, it is automatically transferred to the Liquiditas platform. Suppliers can access these approved invoices via Liquiditas’ web or mobile application. - Supplier Requests Early Payment

Through the Liquiditas platform, suppliers can request early payment of their approved invoices with just one click, streamlining the process. - Liquiditas Pays the Supplier

Liquiditas disburses payment to the supplier immediately, deducting a pre-agreed discount for this early payment service. This provides suppliers with quick access to working capital. - Buyer Repays Liquiditas

When the invoice reaches its due date, the buyer completes payment directly to Liquiditas, closing the transaction loop.

Why Suppliers Should Use Supply Chain Finance

For suppliers in Spain’s construction sector, managing cash flow can feel like a constant balancing act. Long payment terms, rising costs, and fluctuating demand create uncertainty, making it harder to invest in materials, labor, and growth. Supply Chain Finance (SCF) offers a solution by providing faster access to funds without relying on expensive loans or factoring. Here’s how it benefits suppliers in multiple ways:

Significant Cost Savings Compared to Factoring

Many suppliers turn to factoring when they need early payment, but this often comes at a steep price. Factoring companies charge high interest rates and service fees, cutting into already tight profit margins. SCF, on the other hand, provides early payments based on the buyer’s creditworthiness rather than the supplier’s, meaning lower costs and fewer financial risks.

For example:

- A supplier issues a €1M invoice with a 90-day payment term.

- With factoring, they might get an advance of €950K, but after factoring fees and interest, they could end up paying €30K–€40K just to access their money earlier.

- With SCF, they could receive €980K or more, meaning they retain an additional €30K+ that would have been lost with factoring.

Additionally, factoring contracts often require suppliers to sell all their invoices, even if they don’t need immediate cash, locking them into long-term commitments. SCF is more flexible, allowing suppliers to choose which invoices to finance, optimizing costs and financial planning.

Stronger Buyer-Supplier Relationships

Cash flow problems affect suppliers almost always and through this it can also impact relationships with buyers. When a supplier struggles financially, it may result in delayed deliveries, an inability to take on new projects, or an urgent need to renegotiate contract terms. This can weaken trust and even cause buyers to look for alternative suppliers.

With SCF, suppliers gain financial stability, which leads to:

- More competitive pricing – With predictable cash flow, suppliers can offer buyers more favorable rates, securing long-term contracts.

- Better project prioritization – Suppliers with available cash can allocate resources efficiently, ensuring key buyers receive priority service.

- Higher negotiation power – A supplier who isn’t financially strained is in a stronger position to negotiate better payment terms, volume discounts, or exclusivity agreements.

Buyers also benefit from SCF, as they ensure their key suppliers remain financially stable, reducing risks of project delays or supply chain disruptions. This creates a win-win dynamic that fosters long-term business partnerships.

Increased Financial and Operational Flexibility

Unlike bank loans, which require collateral and increase a company’s debt burden, SCF allows suppliers to access cash without taking on new liabilities. This improves financial flexibility in several ways:

- Payroll and labor stability – Spain’s construction sector has seen a 57% drop in job vacancies since 2010, making labor shortages a serious concern. Having working capital available ensures suppliers can pay workers on time and retain skilled labor, preventing project delays.

- Improved purchasing power – When suppliers have immediate cash, they can take advantage of bulk discounts on materials, negotiate better pricing with subcontractors, and secure inventory at lower costs.

- Faster project turnaround – With sufficient liquidity, suppliers can start new projects without waiting for previous payments to clear, increasing their capacity to take on multiple contracts simultaneously.

- Lower financial risk – Many suppliers rely on short-term credit lines to cover cash flow gaps, which come with high interest rates and strict repayment schedules. SCF eliminates the need for costly borrowing while providing predictable and reliable access to funds.

Take Control of Your Cash Flow

If you’re supplying materials, equipment, or services in the Spanish construction sector, waiting 60 or 90 days to get paid isn’t just frustrating – it’s risky. Delays in payments can hold back your business, especially when costs are rising and labor is hard to find.

With Supply Chain Finance through Liquiditas, you don’t have to wait. You can choose to get paid early, on your terms, and use that capital where it matters most – whether that’s buying materials, paying employees, or taking on bigger projects.

There’s no need to commit to loans or factor every invoice. You decide when and how often to use it. And because it’s tied to your buyer’s approval, you benefit from low, transparent costs.

Want to see how much working capital you could access?

Fill out the form in order to find out.