Days Sales Outstanding (DSO) is a critical financial metric that measures the average number of days it takes a company to collect payment after making a sale. Understanding DSO is crucial for businesses as it provides insights into the efficiency of their accounts receivable processes and overall financial health.

A well-managed DSO can improve cash flow, reduce the risk of bad debts, and enhance a company’s ability to invest in growth opportunities. In this article, we’ll explore what DSO is, how to calculate it, and how to interpret the results to make informed financial decisions.

What is DSO?

Days Sales Outstanding (DSO) is a key performance indicator that quantifies the average number of days it takes for a company to collect payment from its credit sales. This metric provides valuable insights into the efficiency of a company’s accounts receivable management, highlighting how well it manages credit sales and collections.

Understanding DSO is crucial for businesses as it directly impacts cash flow and financial stability. Businesses can monitor their debt-to-total-assets ratio (DSO) to see how well they are converting revenues into cash and to make sure they have enough to pay their bills and make investments in expansion prospects.

DSO formula

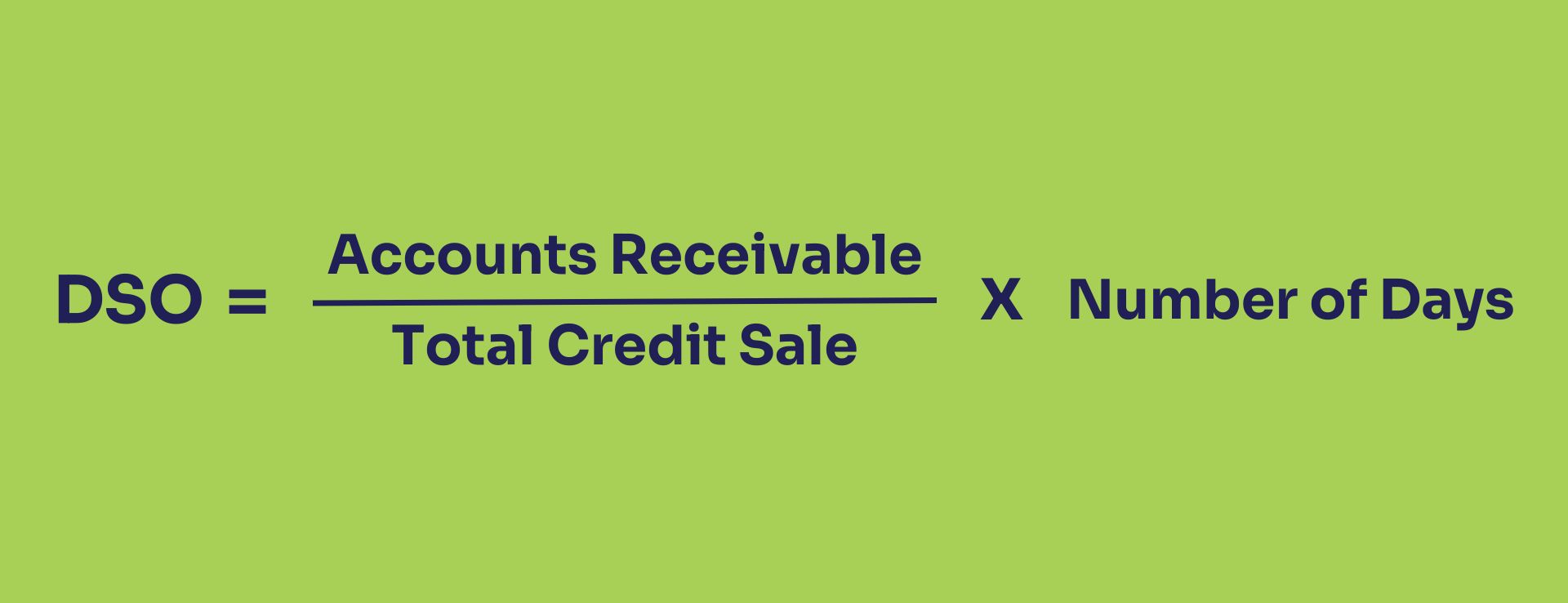

Calculating Days Sales Outstanding (DSO) involves a straightforward formula that helps businesses determine the average collection period for their credit sales. The formula is as follows:

Here’s a breakdown of each component:

- Accounts Receivable: This represents the total amount of money owed to the company by its customers for credit sales. It can be found on the balance sheet.

- Total Credit Sales: This is the total value of sales made on credit during a specific period.

- Number of Days: This is the number of days in the period being analysed (e.g., 30 days, 90 days).

By applying this formula, businesses can determine their DSO and gain insights into their accounts receivable efficiency.

Step-by-Step DSO calculation

Determine accounts receivable

Begin by identifying the total accounts receivable from your balance sheet. Accounts receivable is the total amount of money owed to your company by customers who have purchased goods or services on credit. This figure can be found under the current assets section of your balance sheet. It is essential to ensure that this figure is accurate, as it forms the basis of your DSO calculation.

Identify total credit sales

Next, calculate the total credit sales for the period you are analysing. Total credit sales refer to the sales made on credit terms rather than cash sales. This information is typically recorded in your sales ledger or financial statements. For an accurate DSO calculation, make sure to include only the sales made on credit and exclude any cash sales from this figure.

Choose the time period

Select the number of days for which you want to calculate the DSO. The most common time periods used are 30 days (monthly), 90 days (quarterly), or 365 days (annually). The choice of the period depends on the specific needs of your business and how frequently you want to monitor your DSO. Shorter periods provide more frequent insights, while longer periods offer a broader view of your accounts receivable performance.

Apply the formula

Now that you have all the necessary components, you can apply the DSO formula:

DSO = Accounts Receivable/Total Credit Sale x Number of Days

Example calculation:

Suppose your accounts receivable is $50,000, total credit sales for the period is $200,000, and you are analysing a 90-day period. You would calculate the DSO as follows:

DSO=(50,000/200,000)×90=22.5

This result means that, on average, it takes your company 22.5 days to collect payments from its credit sales.

By following these steps, you can accurately calculate your DSO and gain valuable insights into the efficiency of your accounts receivable management. Regularly calculating and monitoring your DSO helps you identify trends, assess the effectiveness of your credit policies, and take proactive measures to improve your cash flow and overall financial health.

Interpreting the Results

Once you have calculated your Days Sales Outstanding (DSO), it’s essential to understand what the results indicate about your business’s financial health and accounts receivable efficiency.

High DSO:

A high DSO means that it takes longer for your company to collect payments from customers. This can indicate potential issues with your credit policies or collection processes. Extended collection periods can strain your cash flow, making it challenging to cover operational expenses or invest in growth opportunities. If your DSO is significantly higher than the industry average, it might be time to review your credit terms, improve your collection efforts, or reassess your customer creditworthiness.

Low DSO:

A low DSO indicates that your company is collecting payments quickly, which is generally a positive sign of efficient accounts receivable management. Quick collections improve your cash flow, allowing you to reinvest in the business, reduce the need for external financing, and maintain financial stability. However, an extremely low DSO might also suggest overly stringent credit terms that could deter potential customers or impact sales volume.

Industry benchmarks:

Comparing your DSO to industry benchmarks is crucial for context. Different industries have varying norms for payment periods. For example, a DSO of 30 days might be excellent in one industry but average or poor in another. Understanding these benchmarks helps you set realistic targets and evaluate your performance against peers.

Trends over time:

Monitoring DSO over time allows you to identify trends and patterns. An increasing DSO might indicate worsening payment practices or economic conditions affecting your customers. Conversely, a decreasing DSO can signal improvements in your credit and collection processes. Regularly analysing these trends helps you make informed decisions and take corrective actions promptly.

By interpreting your DSO results within the context of your industry and historical performance, you can gain a comprehensive understanding of your accounts receivable efficiency and overall financial health. This analysis enables you to make strategic adjustments to optimise cash flow and sustain business growth.

Conclusion

Maintaining a strong cash flow and making sure your company is financially stable depends on tracking and comprehending Days Sales Outstanding. You can spot possible problems with your accounts receivable procedures, make wise decisions to increase collections and assess your performance against industry standards by routinely calculating and evaluating your DSO. Effective DSO management promotes operational effectiveness and sustainable growth in addition to improving liquidity.